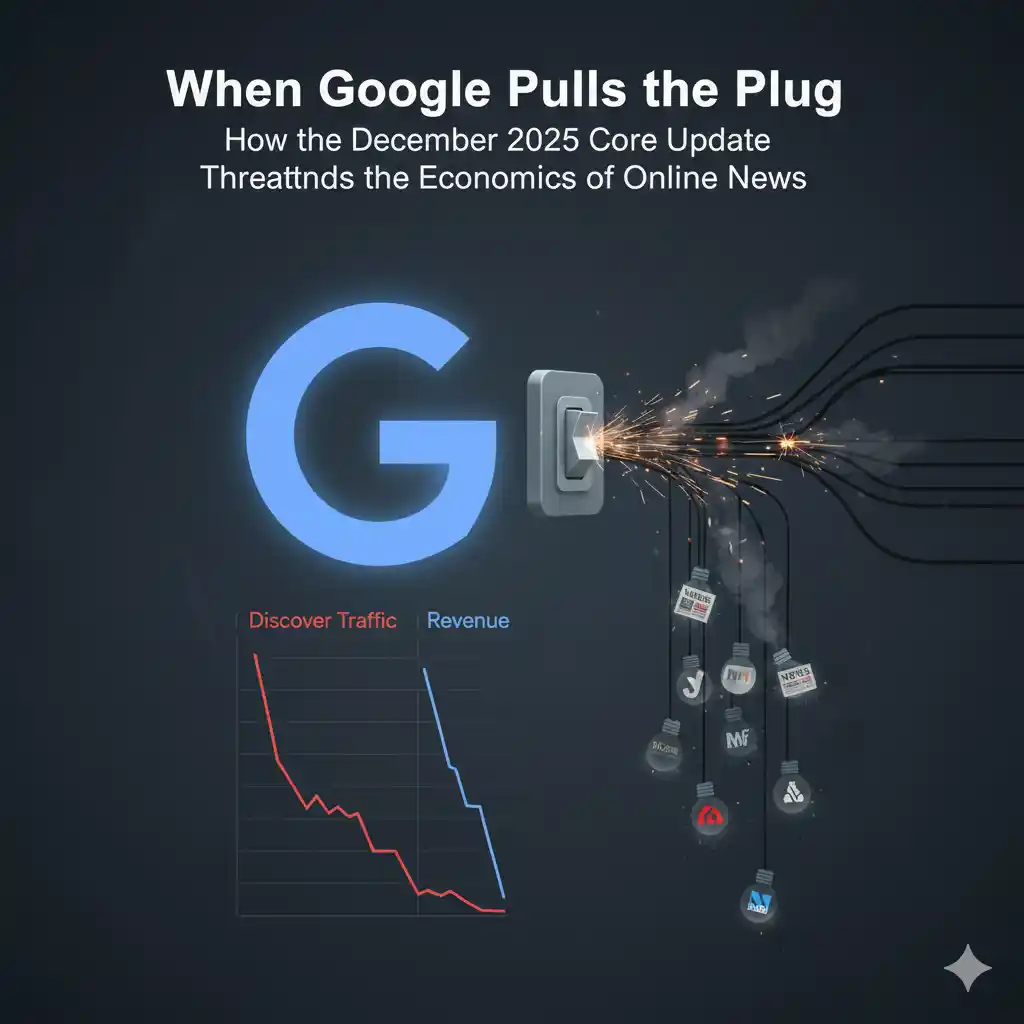

For a decade, publishers have learned to navigate the mercurial world of Google algorithm updates. These shifts are routine in theory — part of how the world’s largest search engine refines relevance and user satisfaction. But the December 2025 core update has broken from that mold in both magnitude and timing, creating a crisis that will reverberate well into 2026 and beyond.

Table of Contents

From Incremental Shifts to Systemic Breaks

Google officially announced the rollout of its December 2025 core update on December 11, 2025, with the usual language about improving relevancy across “all types of sites.” Yet within 24–48 hours, publishers began reporting catastrophic losses in Google Discover traffic — including complete elimination of impressions on sites that had enjoyed stable referrals for years.

For many news publishers, this traffic isn’t a marginal supplement — it is their lifeblood. Discover, the personalized feed inside the Google app and mobile homepage, had become one of the dominant sources of referral traffic, especially as traditional search clicks have slumped amid the rise of AI-generated overviews and other rich results.

Why This Is Different: Timing Meets Trajectory

What distinguishes this update isn’t just noise in the rankings. It’s a coordinated structural shock to key traffic sources at the pinnacle of the ad revenue calendar — the crucial holiday season. December is traditionally when news sites see their most lucrative ad rates and highest engagement. To have core referral channels slashed just before Christmas compounds financial damage with operational instability.

The core update’s timing also amplifies an existing trend: the erosion of third-party traffic dependence. For years, publishers have watched Google recalibrate how it surfaces content — from prioritizing featured snippets and AI Overviews to embedding algorithmic summaries directly within search results. While Google claims these changes serve users, the cumulative effect increasingly diverts attention and clicks away from publisher websites.

The Discover Disconnect: A Traffic Black Hole

Within days of the update announcement, publishers shared anecdotal data showing literally zero daily impressions and clicks where they once saw six-figure figures. This wasn’t a 10% dip or even a 50% slump — it was a complete severing of one of their main distribution engines. Google Help

Behind those numbers lie real business consequences:

- Revenue collapse — Ad rates spike in December; without traffic, publishers forgo predictable seasonal income.

- Audience flight — Loyal readers no longer find articles through passive discovery; fragmented engagement shifts to platforms where content is already commoditized.

- Cost pressures — Newsrooms, already squeezed, face tough choices about staffing, coverage, and investment in quality journalism.

What Google Says vs. What Publishers Experience

Google frames core updates as broad improvements to quality and relevance. But in practice, these updates alter the physics of attention. Publishers report that even established sites with decades of stable performance have been shifted out of top results overnight. Google Help

This disparity matters: when a centralized platform wields algorithmic power that can cut traffic to zero, it shifts market power away from content creators and toward the gatekeeper.

Broader Industry Implications

- News Ecosystem Fragility

- Independent and mid-sized publishers lack the diversified traffic portfolios of major media brands. A collapse in Discover traffic could permanently disable some operations.

- The feedback loop back to society — less diversified news coverage and narrower public discourse — is real and under-examined.

- The AI Amplifier

- Google’s push of AI Overviews and other generative features increasingly aims to satisfy search intent in place, without a click. Even when results cite sources, they extract value while keeping the user on Google properties. Google for Developers

- This dynamic accelerates a fundamental shift: information may become ubiquitous, but traffic — and thus revenue — becomes scarce.

- Regulatory Backdraft

- Globally, regulators are scrutinizing big tech’s leverage over content creators. The EU has already signaled interest in how AI models use and redistribute publisher content — potentially without commensurate compensation. tdmp.co.uk

- Continued traffic declines make the case for legislative action more urgent.

The Road Ahead: Survival and Adaptation

Publishers can’t simply wish away algorithmic volatility. But the current disruption underscores two hard truths:

- Control over distribution is no longer optional — owning direct audience channels (email newsletters, apps, subscriptions) matters more than ever.

- Diversification isn’t just strategic — it’s existential — dependence on a single platform for the bulk of traffic is no longer tenable.

Previous Google core update explainers

AI Overviews / generative search articles

Publisher monetization or media business analysis

An Inflection Point, Not an Outage

The December 2025 core update isn’t a hiccup. It’s a structural shift in how and where audiences engage with journalistic content. Whether this accelerates a more resilient, direct-to-audience news ecosystem or deepens the digital divide between major platforms and independent publishers depends on how industry and policy respond.

What used to be an SEO challenge has now become a broader strategic imperative for the future of quality journalism.

3 thoughts on “When Google Pulls the Plug: How the December 2025 Core Update Threatens the Economics of Online News”